VinciWorks’ new tax evasion course takes a modern, fresh approach to tax evasion training with a focus on industry-specific guidance, role-relevant scenarios and an interactive, engaging approach to ensuring all staff have the skills and understanding they need to prevent facilitation of tax evasion.

The Criminal Finances Act created a corporate criminal offence for failing to prevent the facilitation of tax evasion. This places the responsibility on businesses to have “reasonable procedures” in place to ensure none of their employees or contractors are involved in helping someone evade their taxes anywhere in the world. Guidance from HMRC advises that reasonable procedures should be guided by the following 6 principles:

- Risk assessment

- Proportionality of risk-based prevention procedures

- Top-level commitment

- Due diligence

- Communication and training

- Monitoring and review

Training is one of the key planks of a business response to the obligations imposed by the Criminal Finances Act 2017 which introduced a corporate offence of “failure to prevent” facilitation of tax evasion. Businesses can be found criminally liable if their staff or third parties, such as service providers, facilitate tax evasion. Having reasonable procedures such as training in place is a defence.

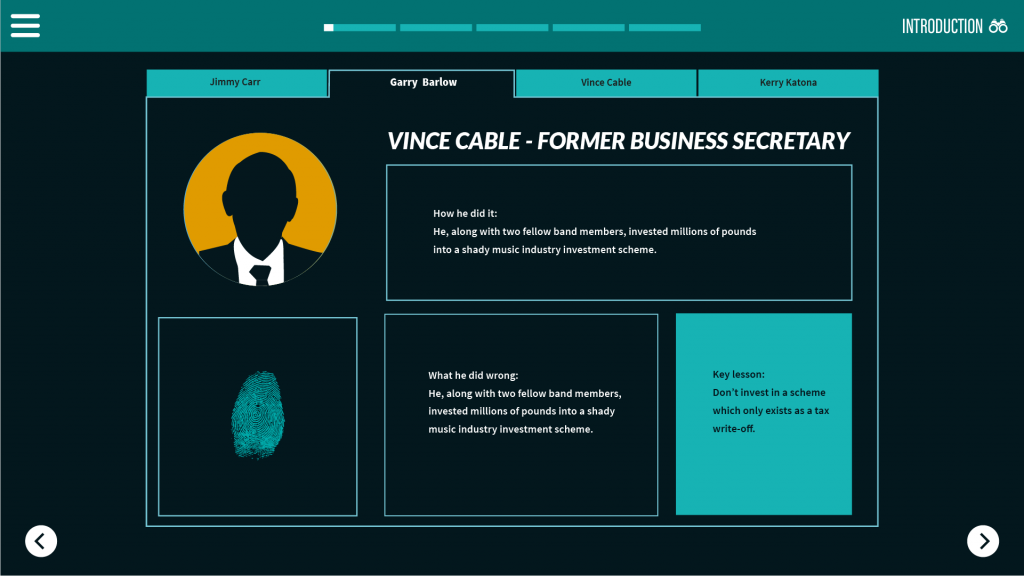

Criminal Finances Act: A Practical Overview focuses on upskilling all staff to have the tax literacy to understand the potential risks every business faces when it comes to the complex world of tax compliance. The course takes users through what they need to know in their role in order to understand what tax evasion is, how it occurs, how we are affected, and what they must do to stop it. The course begins with an interactive game that presents strategies people might use to evade tax.

Course overview

The course combines realistic scenarios with detailed, relevant information for the user based on their role in the company, their location and how frequently they engage in activities which could potentially pose a risk for facilitation of tax evasion. This can include paying invoices to giving out tax advice.

Alongside detailed information on reasonable procedures and industry-specific scenarios, the course presents users with an interactive game to help internalise the potential tripping points in their daily job which could result in facilitating tax evasion.

The course also addresses the challenge of offshore tax jurisdictions and gives guidance on how to spot red flags. Organisations can create personalised guidance for their staff, with information about what to do and who to contact when there is a concern of tax evasion from a client.

Course features

- Users who feel they need a quick refresher on the topic can instantly choose to learn an additional module

- Interactive game where users try and evade £1m in tax

- Begins with a unique builder that instantly generates a course that caters to the role of each user

- Interactive scenario questions to test users’ ability to spot red flags

- 100% customisable — Edit every word and build custom modules

Course outcomes

Those who take the course will understand:

- The relationship between tax evasion, tax avoidance and tax mitigation

- The social and economic effects of failing to prevent tax evasion

- What is meant by “reasonable procedures”

- The penalties for committing an offence under the Criminal Finances Act

- Red flags for spotting facilitation of tax evasion

- Interactive quizzes to review knowledge learnt

This new coursecan be fully customised to be relevant to your organisation, the industry and each department within the organisation.